Loonie falls below 69 cents U.S. and gold breaches US$2,800

Article content

Article content

Article content

It’s starting to look like we might not be able to dodge those tariffs after all.

Canadians breathed a sign of relief when newly elected U.S. President Donald Trump failed to carry out his threat on his first day of office.

Turns out that may have been just a temporary reprieve.

That punishing reality loomed closer yesterday when Trump reinforced that he would carry out his threat to impose 25 per cent tariffs on imports from Canada and Mexico on Feb. 1.

Advertisement 2

Article content

“We’ll be announcing the tariffs on Canada and Mexico for a number of reasons,” Trump told reporters Thursday in the Oval Office.

“Number one is the people that have poured into our country so horribly and so much. Number two are the drugs, fentanyl and everything else that have come into the country. Number three are the massive subsidies that we’re giving to Canada and to Mexico in the form of deficits.”

The market reaction was swift. The Canadian dollar shed as much as 1.2 per cent, falling to 68.5 cents U.S. late last night.

The loonie has been facing some major headwinds in recent months on concerns about tariffs, the economy and the growing gap between the Bank of Canada and Federal Reserve interest rates.

It has lost about 6 per cent against the U.S. dollar in the last quarter and hit its lowest since 2020 earlier this year, Bloomberg reports.

The currency may fall even further if tariffs, as predicted, bring on a recession and push the Bank of Canada to cut interest rates deeper than planned.

Trump’s threat, on the other hand, was a boon for gold as investors ran for safety.

Article content

Advertisement 3

Article content

The yellow metal was trading at an all-time high of US$2,842.80 this morning after leaping 1.3 per cent last night. The “swift move to safety” was sparked by the tariff threats, escalating geopolitical tensions, rising U.S. government debt and fears of a potential tech stock rout that could bring on a global selloff, said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

“Good news is that the U.S. tariffs won’t make America Great Again. The bad news is that it will be lose-lose globally,” she said in her note this morning.

Ozkardeskaya said speculative buying of gold has increased since the beginning of the year, partly because of concerns that Trump will drag the world into a trade war and fears over high tech stock valuations and the possibility of a market correction.

“The question is: could gold get more expensive? Yes, it could. A sizeable risk selloff in global financial markets could drive gold to fresh highs,” she said.

The fate of Canada’s biggest export to the United States is still uncertain. Trump said Thursday he was considering if Canadian oil would be exempted from tariffs and would base his decision on the price of crude.

Advertisement 4

Article content

“We don’t need the products that they have. We have all the oil that you need. We have all the trees you need,” Trump said, referring to Canadian goods.

There is still a chance the tariff threats are a negotiating tactic. Last weekend, Trump threatened and then pulled back on tariffs after Colombia agreed to his terms in a dispute over deported migrants.

This time the stakes are higher, say economists — not just for Canada and Mexico but for the United States itself.

“The potential for such sizeable economic impacts ought to act as enough of a deterrent that Trump will not end up implementing these higher tariffs,” said Matthew Martin, senior U.S. economist at Oxford Economics.

Fingers crossed.

With files from Bloomberg and The Associated Press

Sign up here to get Posthaste delivered straight to your inbox.

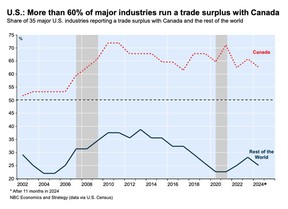

If Donald Trump is worried about trade deficits with Canada he should take a look at today’s chart from National Bank. Sixty per cent of the 35 major American industries in bilateral trade with Canada have a trade surplus, compared with 25 per cent of the industries that have a surplus when trading with the rest of the world.

Advertisement 5

Article content

“Our free trade agreements with the U.S. have proven highly advantageous for Uncle Sam,” said National economists Stéfane Marion and Matthieu Arseneau.

“The American government undeniably shares a “special relationship” with Canada, characterized by a trade dynamic that is significantly skewed in favour of the United States when it comes to the distribution of trade surpluses.”

- Today’s Data: Canada GDP, United States personal income and spending

- Earnings: Imperial Oil Ltd., Chevron Corp., Exxon Mobil Corp., Baker Hughes Co.

An Ontario couple with two small children, a $250,000 mortgage and just $75,000 in retirement savings has 15,000 a year left over after paying the bills. Would it be better to put this money towards paying off the mortgage or save the money for retirement in an RRSP or tax-free savings account (TFSA)? FP Answers has some strategies to consider.

Advertisement 6

Article content

Calling Canadian families with younger kids or teens: Whether it’s budgeting, spending, investing, paying off debt, or just paying the bills, does your family have any financial resolutions for the coming year? Let us know at wealth@postmedia.com.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Recommended from Editorial

-

Young Canadians are losing homeownership hope

-

Who would hurt the most if Donald Trump unleashes tariff tsunami

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

Canadian dollar tanks, gold soars as Donald Trump vows tariffs

2025-01-31 13:17:08