Early estimate for November shows GDP shrinking for first time this year

Article content

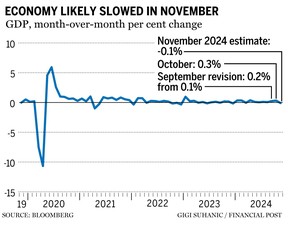

Canada’s economy expanded more than expected in October, but an early estimate suggests the momentum died in November.

Article content

Article content

Gross domestic product expanded by 0.3 per cent in October, Statistics Canada said Monday, with the monthly gain driven mainly by mining, quarrying, and oil and gas extraction.

The rise in GDP beat economists’ forecast of 0.2 per cent, with 10 of the economy’s 12 sectors expanding.

Advertisement 2

Article content

Bank of Canada governor Tiff Macklem said policymakers would like to see growth pick up after they made two consecutive cuts of 50 basis points to the central bank’s policy rate in October and December, bringing the rate down to 3.25 per cent, the top of its neutral range.

He also signalled a more “gradual approach” to monetary policy in the new year.

However, Statistics Canada’s advance estimate for November has the economy shrinking by 0.1 per cent, the first negative reading this year.

Benjamin Reitzes, an economist at the Bank of Montreal, said despite the negative contraction in November, growth in the fourth quarter is tracking at 1.7 per cent, which is in line with the bank’s forecast, but below the Bank of Canada’s two per cent growth projection made in its monetary policy report in October.

“There’s nothing in these figures to change the Bank of Canada’s more gradual rate cut narrative,” he said in a note.

Abbey Xu, a Royal Bank of Canada economist, pointed out that November’s contraction is an advance estimate, which is “typically subject to significant revision,” but it’s in line with the advance estimates of a slowdown in wholesale and manufacturing sales, and a pullback in consumer spending for the month, which RBC is tracking.

Advertisement 3

Article content

In October, oil and gas extraction grew by 3.1 per cent, with oilsands output increasing by 5.2 per cent, its largest monthly gain since December 2020.

Mining and quarrying expanded by 0.8 per cent during the month, due to increases in copper, nickel, lead and zinc ore mining.

Manufacturing grew by 0.3 per cent in October, driven by a jump in non-durable goods following four consecutive months of decline.

Andrew Grantham, a senior economist at Canadian Imperial Bank of Commerce, said the economy is still not growing above its long-run potential and further rate cuts will be needed.

“While there is evidence that interest rate-sensitive areas of the economy (i.e., real estate, retail sales) have already strengthened as the Bank of Canada has lowered rates, further interest rate relief will be needed in the new year to help close the output gap,” he said in a note. “We continue to see rates needing to dip slightly below neutral, forecasting a low of 2.25 per cent for the overnight rate in 2025.”

Real estate and rental leasing rose by 0.5 per cent, the sixth consecutive increase and the largest monthly gain since January. Much of the gain was driven by higher home sales in Toronto and Vancouver, with the industry’s activity level in October hitting its highest point since April 2022.

The construction sector rose for the third month in a row by 0.4 per cent, led by non-residential building construction.

Recommended from Editorial

-

Retail sales in Canada fall flat after four-month surge

-

Canadian dollar falls below 70 cents U.S. on political risk

Wholesale trade was up 0.5 per cent. Motor vehicles and vehicle parts and accessories grew by 3.3 per cent, due to higher vehicle sales during October.

• Email: jgowling@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Canada’s GDP shrinks for first time this year

2024-12-23 14:07:44