Net income for non-financial corporations drops to lowest levels since pandemic

Article content

Article content

Article content

Just as the going is about to get tough(er), data signals all is not well in Corporate Canada.

Results for the third quarter revealed that profits and investment plunged for many Canadian businesses.

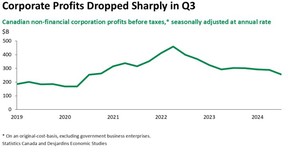

For non-financial corporations, profits fell to their lowest levels since the pandemic, dropping more than 38 per cent, said Florence Jean-Jacobs, Desjardins’ principal economist.

Advertisement 2

Article content

Telecoms and mining and quarrying posted the biggest declines, with both sectors struggling with higher costs amid challenging market conditions, she said.

Net income also declined for auto makers as they retooled assembly plants in the quarter, while higher earnings in the oil and gas sector helped stem the decline.

“Corporate results in Q3 confirmed that the market environment remains challenging and uncertain for many businesses,” wrote Jean-Jacobs in a report.

Investment in machinery and equipment by non-residential businesses also dropped 11.3 per cent, wiping out most of the gains from the quarter before.

“While interest rates and cost-related obstacles are easing, Canadian companies are not quite ready to press on the investment accelerator,” said Jean-Jacobs.

“Higher expenses … and an uncertain trade environment appear to be constraining capital spending and expansion plans.”

Uncertainty over the trade environment spiked last week when President-elect Trump promised 25 per cent tariffs on all goods from Canada and Mexico, starting the first day he took office.

Article content

Advertisement 3

Article content

While most think tariffs of this magnitude are just a negotiating tactic, with $3.6 billion in goods crossing the U.S.-Canada border daily, the impact would be huge if the threat became reality.

A 10 per cent tariff would shave 2.4 percentage points off Canadian GDP over two years and put about 500,000 jobs at risk, said Andreas Schotter, a professor at the Ivey Business School in London, Ont.

A tariff of 25 per cent would triple those job losses and impose an even bigger hit on economic growth.

A survey by Statistics Canada in early November found that almost three-quarters of businesses were optimistic about the future, “but with President-elect Trump’s tariff threat, the outlook could worsen, especially for businesses that depend on exports to the U.S.,” said Jean-Jacobs.

Now is not the time for Canadian businesses to be cautious, she said.

“With an aging workforce, planned reduction in population growth that could temper Canada’s labour supply, and a tough competitive environment, Canadian firms need to accelerate their digital transformation and invest in productivity-enhancing processes and equipment.”

Advertisement 4

Article content

Sign up here to get Posthaste delivered straight to your inbox.

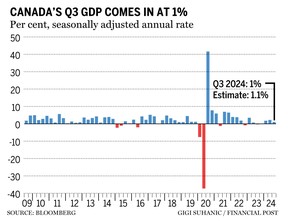

The economy grew 1 per cent in the third quarter, but if it wasn’t for the population boom it would have been in contraction, said Charles St-Arnaud. The chief economist for Alberta Central calculates that if population growth was the same as before the pandemic, the economy would have shrunk by 0.2 per cent quarter over quarter.

Gross domestic product per capita fell for the sixth quarter in a row in the three months to September. “Such a decline has never been seen outside a recession,” said economists with National Bank of Canada.

- Today’s Data: United States construction spending, ISM manufacturing

Recommended from Editorial

-

Canada retreats from the edge of the mortgage renewal cliff

-

Renters rejoice, relief may be on the way

Whether by choice or necessity, living on one income can be challenging, especially with high living costs.

Advertisement 5

Article content

From deciding on the size of their home to the overhead it takes to manage the home, the number of vehicles, choosing child caregivers or family recreation, and even organizing holiday celebrations and special occasions, thoughtful preparation and smart strategies are essential.

It’s entirely possible to lead a rich and fulfilling life on a single household income without getting into debt, but before you take the plunge, Sandra Fry advises you consider these three things.

Wealth builders

If Warren Buffett had a TFSA, how much would it be worth today? In a fun exercise, we used Canada’s tax-free savings account rules and Buffett’s Berkshire Hathaway average 19.8 per cent returns over 62 years to calculate what he might have ended up with in that registered account. Before you click on the answer, can you guess?

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Advertisement 6

Article content

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

Canadian business profit and investment plunge

2024-12-02 12:59:59