Almost of half of Canadians could see hikes of $1,000 a year under high-rate scenario, study finds

Article content

Canada has committed to net-zero greenhouse gas emissions by 2050, and for many Canadians that will mean savings on their energy bills — but not all.

A new report by Electrifying Canada’s Transition Accelerator that looks at the affordability of a net-zero future finds that most households will come out ahead when the country goes fully electric, but a “significant portion” will be paying more.

Advertisement 2

Article content

The analysis covers the costs of buying and operating heating and cooling equipment in the home and personal transportation under three electricity rate scenarios: low, medium and high, all of which are higher than today.

Even under the high-rate scenario, the median household could save about $150 a year, the report says, because more efficient electric technologies such as heat pumps and electric vehicles will offset rising electricity rates.

In the low-rate scenario, the median household could save more than $1,000 a year.

Atlantic provinces, where many households now heat with oil and gas and energy costs are highest, stand to see the biggest savings. The median household in Nova Scotia could see their energy bills reduced by 24 per cent or about $2,400 a year, said the report.

“In these regions, the transition to an electrified future will substantially improve energy affordability,” it said.

Other regions will need some help.

Households in Alberta and Saskatchewan, where natural gas is widely used for heating and where projected electricity rates are among the highest, are likely to see their energy costs rise.

Article content

Advertisement 3

Article content

Lower-income households who do not own a vehicle are also vulnerable to rising energy costs because they will miss out on transportation savings. Households with a car will save money as EVs come down in price, and they pay less for fuel and maintenance. The report expects electric vehicles to reach price parity with gas-powered by 2050 or earlier.

“While a majority of households will experience energy wallet savings under the full range of electricity rate scenarios, a significant portion of households will see increases in their energy wallet costs relative to today,” said the report.

“For these households, energy affordability concerns will grow absent mitigating supports or other policy interventions.”

The report estimates that under low to medium electricity rates, 23 and 33 per cent of households will experience higher energy costs, respectively.

The median annual increase in their costs would be between $764 and $861.

In the high-rate scenario, that share of households rises to 48 per cent, with an annual increase of over $1,000.

The report stresses that while the transition to electricity is good news for most Canadians, support for those who will face rising costs is crucial to ensuring its success.

Advertisement 4

Article content

Governments have the tools to make the transition affordable for all Canadians and provincial and federal governments must work together, the report said.

“The geographic differences in energy wallet impacts underscore the need for coordinated efforts to achieve affordable electrification nationwide.”

Sign up here to get Posthaste delivered straight to your inbox.

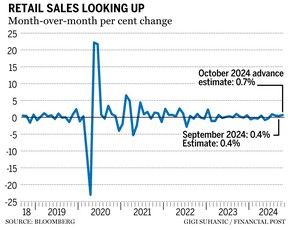

The Canadian consumer is back. Retail sales rose for the fourth month in a row in October, data suggested Friday, the longest growth streak since early 2022.

With September’s increase, third-quarter retail sales were up 0.9 per cent — a big difference from the first half of the year, which saw the largest contraction since 2009 outside the pandemic, says Bloomberg.

Lower interest rates are fuelling the shopping spree which should get another boost after the federal government announced last week a GST/HST tax holiday from mid-December to mid-February.

“This holiday shopping season may have a bit more sparkle than expected,” said Maria Solovieva, an economist with Toronto Dominion Bank in a note.

Advertisement 5

Article content

- A strike by about 55,000 workers at Canada Post heads into its second week ahead of the key holiday season.

- Alimentation Couche-Tard Inc. will release its second-quarter results today after the close of markets. The earnings come as the Quebec-based retailer faces a rival in its attempt to buy Seven & i Holdings Co., the Japanese company that owns the 7-Eleven convenience store chain.

Recommended from Editorial

-

What GST break could mean for Bank of Canada

-

How much can the inheritances help young homebuyers?

A reader who has three children by two marriages needs advice on how to divide up his estate fairly in his will. FP Answers explains that first he has to satisfy all statutory requirements including family law, income tax, and Dependants Relief legislation. Find out more

Hard earned truths

In an ongoing series about what the next generation needs to know to build wealth, we offer Hard Earned Truth #7: The pros can’t pick stocks and neither can you. So, what should an investor do? Read on.

Advertisement 6

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

In net-zero 2050, households in these provinces will pay more

2024-11-25 13:14:26