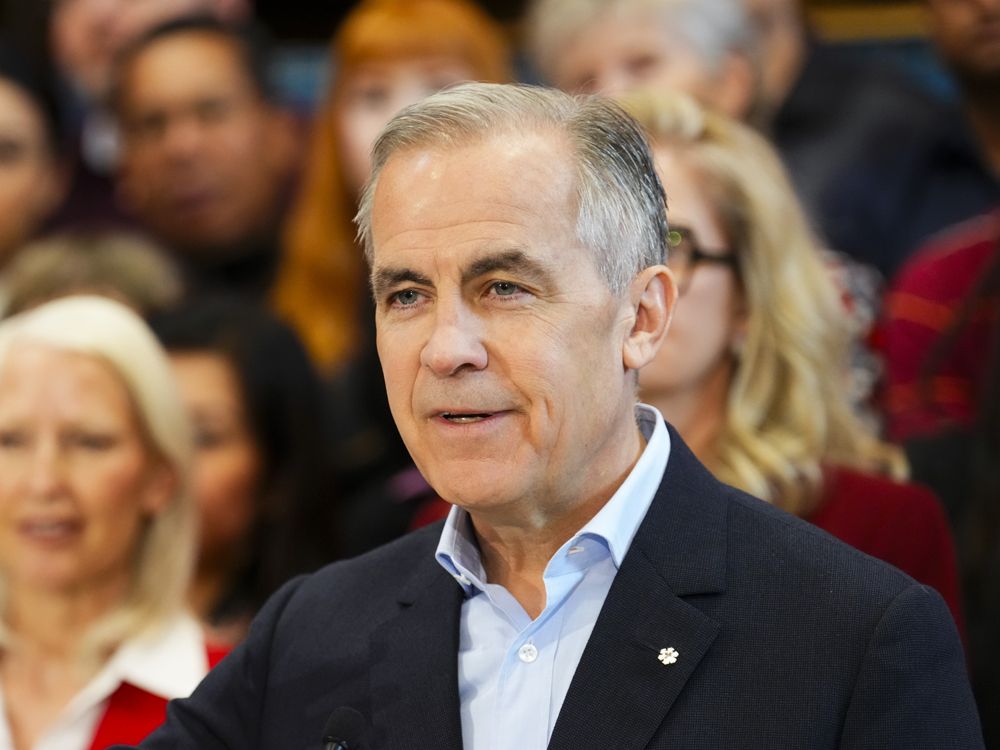

Policymakers find themselves in an awkward position. some say

Article content

Canadian inflation would have accelerated further in January were it not for Ottawa’s tax holiday, putting the Bank of Canada in an awkward position when it comes to its next interest rate decision, some economists said.

Article content

Article content

The consumer price index rose 1.9 per cent in January year over year, according to Statistics Canada data released on Tuesday. That met expectations, but minus the GST/HST holiday, which ended on Feb. 15, economists estimated inflation would have risen to 2.5 per cent for the month.

Advertisement 2

Article content

Signs of a inflation heating up could spell the end of the Bank of Canada’s rate-cutting cycle. The central bank started hiking interest rates due to a large increase in the rate of inflation.

At the same time, Canada’s economy faces an existential threat in the form of United States President Donald Trump’s tariffs.

With several crosscurrents at play, here’s what economists think the Bank of Canada might do at its next interest rate announcement on March 12.

‘Take a pause’: RBC

“Overall, a middle-of-the-road inflation print after an upside surprise in December is less desirable than what we and the central bank would like to see,” Abbey Xu, a Royal Bank of Canada economist, said in a note.

Excluding the effects of taxes, CPI-trim and CPI-median, the Bank of Canada’s preferred inflation measures, rose to 2.7 per cent year over year, though she said they were “more in line” with Bank of Canada targets on a monthly basis.

Xu said the “super-core” measure of CPI-trim, which excludes shelter, pulled back, while the impact of mortgage costs on CPI growth is shrinking as lower interest rates work their way through the system.

Article content

Advertisement 3

Article content

Still, a bit more than half of the CPI’s components posted price increases above three per cent on a three-month annualized basis, a share that is higher than before the pandemic.

“We think the (Bank of Canada) will want to wait for more data for hints on how underlying price pressures are evolving excluding impact from the tax holiday, and take a pause from cutting interest rates in their next meeting in March,” Xu said.

‘A lot could change’: TD

“There are signs that price pressures could move higher in the months to come” now that the federal Liberals’ tax holiday is over, James Orlando, a senior economist at Toronto-Dominion Bank, said in a note.

He is among those economists who estimated that minus the tax break, which applied to items such as children’s toys, food in restaurants and some alcoholic drinks, the CPI would have risen to 2.5 per cent year over year.

Orlando also noted that the three-month annualized core measures on inflation are running at around three per cent, “signalling that core inflation should continue to grind higher.”

Policymakers will have to choose between responding to the threat tariffs pose to economic growth or training their sights on inflation.

Advertisement 4

Article content

“The (Bank of Canada) is in a difficult place,” Orlando said.

Markets are still betting on a 25-basis-point cut next month, though those bets slightly retreated following the data release, he said.

“There is plenty of time between now and March 12, and if the (U.S.) president’s first few weeks are anything to go by, a lot could change before then,” Orlando said.

Price pressures building: Capital Economics

“The GST holiday meant that headline inflation remained below the two per cent target in January, but there is clear evidence that underlying inflation pressures are building,” Stephen Brown, deputy chief North America economist at Capital Economics Ltd., said in a note.

Canadians paid more for gasoline last month, as prices at the pump rose 8.6 per cent from January 2024, while natural gas prices climbed 4.6 per cent. Furthermore, prices for new vehicles were up and he highlighted a jump in the cost of household goods, clothing and footwear.

Brown, like Orlando, trained his spotlight on the core measure of inflation that adjusts for taxes, noting they are tracking at the top end of the Bank of Canada’s inflation target of three per cent.

Advertisement 5

Article content

Policymakers have recently muted the importance of CPI-trim and CPI-median in their deliberations, he said.

“But the strength of underlying inflation pressures does suggest that, if those tariffs or others of a similar magnitude are not imposed, then the Bank (of Canada) will soon bring its loosening cycle to an end,” he said.

Inflation largely ‘resolved’: RSM Canada

Inflation in Canada has largely been “resolved,” despite some stickiness in the core measures, Tu Nguyen, an economist at national assurance, tax and consultancy firm RSM Canada, said in a note.

As evidence, she pointed to six months’ worth of CPI readings that put inflation at or below the Bank of Canada’s two per cent target.

Nguyen said the Bank of Canada will turn its attention to the February labour data, which comes out March 7, to decide its next move on interest rates.

Recommended from Editorial

“If tariffs do not materialize within the next month, the Bank of Canada might pause for a month as the job markets have held up thus far with healthy job gains,” she said. “But if tariffs and retaliation were implemented, another cut is warranted.”

• Email: gmvsuhanic@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Bank of Canada could skip March rate cut on inflation data

2025-02-18 16:34:42