As the final trading days of 2024 wind down, BMO Capital Markets takes a look at the year that was

Article content

Article content

Article content

It’s been another banner year for investors, despite last week’s stumble. The S&P 500 is headed for the finish line up 25 per cent, following a more than 20 per cent gain the year before.

As the final trading days of 2024 wind down, BMO Capital Markets economist Robert Kavcic takes a look at the year’s hits and misses.

The markets

The S&P 500 is up 25 per cent since the end of 2023 with the top seven biggest technology stocks accounting for more than half of that advance.

Advertisement 2

Article content

The Nasdaq has led the gains so far, up 30 per cent after a stunning 43 per cent rise in 2023. If this year’s advance holds, it will be only the third back-to-back increase this high since the late 1960s, said Kavcic.

The TSX has also had a solid year, up 17.4 per cent.

Most improved

The United States’ robust economy, interest rate cuts and a steepening yield curve made bank stocks a winner this year, said Kavcic. The U.S. sector rallied 34 per cent after the bank failures of 2023. Earnings results among Canadian banks were more “hit-and-miss” but the sector still managed a 16 per cent gain, up from 3.6 per cent the year before.

Underperformers

It was a tough year for resources and U.S. energy and materials are down on the year, said Kavcic. The rally in gold prices helped Canada, but oil prices are wrapping up the year about where they started with West Texas Intermediate at around US$70.

Worst performers

Canadian telecoms were the worst performers in North America, pressured by tougher competition, high debt loads and Ottawa’s new caps on population growth, said Kavcic. The sector is down more than 20 per cent and the hits keep coming.

Article content

Advertisement 3

Article content

Telecom companies were the biggest losers on the TSX yesterday, which one analyst attributed to tax-loss selling at the end of the year. Rogers Communications Inc. fell 0.7 per cent Monday after the Competition Bureau Canada said it was suing the company for allegedly making misleading claims about its infinite wireless plans.

BCE Inc. was down almost 1.4 per cent and Telus Corp. dropped 0.9 per cent.

“It’s been a tough year for the communication services sector,” Kevin Burkett, a portfolio manager at Burkett Asset Management, told The Canadian Press.

And then there’s bitcoin …

It’s been a year of milestones and records for the digital currency. Bitcoin ETFs began trading in the United States on Jan. 11, 2024, and by March the price had hit a new record of US$73,000 as investors poured in. (Note: Bitcoin ETFs launched in Canada in February 2021, the first in the world.)

But there were more records to come. The election of Donald Trump, known for his pro-crypto policies, pushed the currency over US$100,000 this month for the first time.

That rally has since flagged, with bitcoin trading at US$93,944 this morning

Advertisement 4

Article content

Happy holidays from all of us at the Financial Post. Posthaste will take brief break and return on Jan. 2

Sign up here to get Posthaste delivered straight to your inbox.

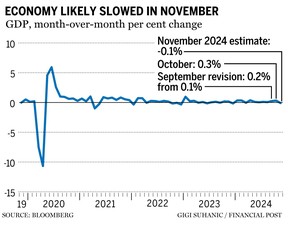

A pause or a cut? Gross domestic product data that came out Monday evoked a mixed reaction from economists, who were eager to see how the latest numbers would affect the Bank of Canada’s next decision.

GDP grew by 0.3 per cent in October, stronger than expected, but Statistics Canada’s early estimate for November suggested the economy shrank by 0.1 per cent, the first contraction this year.

Oxford Economics says the reading shows the economy is not firing on all cylinders and predicts the central bank will press on with four more 25-basis-point cuts to bring the interest rate to 2.25 per cent by mid-2025.

Capital Economics, however, had a more upbeat take on the economy. Stephen Brown said the hit to November’s GDP was hardly surprising considering the impact of two earlier port strikes and the Canada Post walkout that started Nov. 15. Even with November’s dip, fourth-quarter GDP growth will be close to the Bank of Canada’s forecast of 2 per cent annualized, he said, increasing the odds that the bank will pause next month.

Advertisement 5

Article content

- The TSX closes at 1 p.m. ET for Christmas Eve

- Today’s Data: United States building permits, durable goods orders, new home sales

Recommended from Editorial

-

Don’t give up on gold yet — it’s got a secret weapon

-

Canadians plan to tighten their belts after the holidays

From a drug smuggling CEO to smoking senior executives, five unusual tales from portfolio manager Peter Hodson take a look at the lighter side of his career in the investment and portfolio management industry. Read more

As inflation and the cost of living soar for Canadians, consumers are getting ‘justifiably angry’ about junk fees — We look at what the problem is, and what are some solutions. Read more

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Advertisement 6

Article content

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

Market hits and misses in 2024, a record-breaking year

2024-12-24 13:07:05