Scotiabank and BMO join pack calling for 50-bps interest rate cut

Article content

Article content

Article content

Just a week ago it was a coin toss whether the Bank of Canada would cut 25 basis points or 50 off its benchmark interest rate on Wednesday.

But that all changed Friday.

After the release of data that showed the jobless rate had hit a seven-year high, markets boosted expectations of a 50-bps cut to 80 per cent and two of the Big Six bank economists changed their forecast.

Advertisement 2

Article content

The Bank of Nova Scotia and Bank of Montreal joined the pack predicting the central bank will cut the interest rate to 3.25 per cent on Dec. 11.

The rise in unemployment to 6.8 per cent was enough to change the mind of economists led by BMO Capital Markets chief economist Douglas Porter.

“That’s the highest jobless rate in nearly eight years (again, apart from 20/21), and if there is one indicator that will stress the Bank of Canada, this would be the one,” said Porter in a note after the data.

“When the facts change, we change, and the sharp rise in the jobless rate is a big change, especially after two months of calm,” he said.

Porter stressed that a bigger cut is what BMO believes the Bank of Canada will do, not necessarily what it should do.

He says there is a “solid” case for a smaller cut as consumer demand comes back to life, core inflation picks up, the Federal Reserve turns cautious and the Canadian dollar sinks towards 20-year lows.

“But the Bank seems biased to ease quickly, and the high jobless rate provides them with a ready invitation,” said Porter.

Scotiabank Economics vice-president Derek Holt now sees a 70 per cent of a 50-bps cut this week, though he argues that his interpretation of the jobs report recommends against it.

Article content

Advertisement 3

Article content

He believes the central bank will prioritize the risk of inflation dropping too low over the risk of inflation rising again.

“Time will tell if it’s the right approach, but it’s their bias,” he said.

If U.S. President-elect Donald Trump follows through on his threat to impose tariffs, a bigger cut would help the economy, but if Trump doesn’t or if Canada retaliates with tariffs of its own, inflation could take off again.

“I have a hunch that we’re at risk of getting too far ahead of ourselves in the face of pent-up demand, pent-up savings and the lagging effects of prior immigration by permanent residents into the housing and consumer markets,” said Holt.

The Bank of Canada may also find it difficult to explain if it cuts just 25 bps why it is doing less than markets expect, considering its dovish tone in recent meetings and ambivalence about the effects on the Canadian dollar, he said.

“If they do upsize again, then I hope there is a much more careful bias if not an outright signal that at 3.25 per cent and 175 bps below the peak policy rate they are prepared to take a bit of a breather and see how the rest unfolds,” Holt wrote in a note.

Advertisement 4

Article content

Not everyone is convinced the bank will go big.

BofA Securities’ Canada economist Carlos Capistran still expects a 25-bps cut Wednesday, putting the rate at 3.5 per cent by year end.

While the unemployment rate surged in November, the economy gained 51,000 jobs, doubling expectations, which BofA says signals a strengthening economy.

“We expect the BoC to cut 25 bp again in January to reach a terminal rate of 3.25 per cent as an expectation of higher U.S. rates by our U.S. economics team limits the room to cut for the BoC,” he said in a note.

Capital Economics also sees signs of recovery and thinks the Bank of Canada will put more weight on the gain in jobs, rather than the rise in the unemployment rate.

“That said, markets pricing in a 50-bp cut does increase the likelihood of it happening, as the bank risks sending an unnecessarily hawkish signal otherwise,” said Thomas Ryan, Capital’s North American economist.

Sign up here to get Posthaste delivered straight to your inbox.

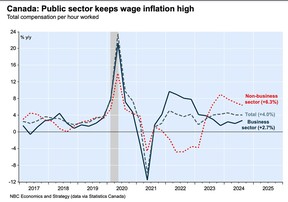

Wage growth continues to worry inflation watchers.

Data out Friday showed hourly compensation growth is still running high at about 4 per cent year over year, more than the average of 3 per cent between 1999 and 2019, despite the deterioration in the labour market, said Matthieu Arseneau, an economist with National Bank of Canada.

Advertisement 5

Article content

As his chart shows, civil servants (the non-business sector) with pay rises of 6.3 per cent over the past year appear to be driving the numbers. Wage growth in the private sector (business sector on the chart) has settled back to the normal pace at 2.7 per cent.

“Since the CPI basket is mostly produced by private firms, the current composition of wage pressures, concentrated among government employees, should mean less concern for the central bank’s inflation outlook,” said Arseneau.

- The Canada Post strike enters its fourth week. Calls for government intervention in the contract talks have been mounting from the business community, but the government has so far said it’s not going to step in.

- Today’s Data: United States wholesale trade sales

- Earnings: North West Co Inc., Oracle Corp.

Recommended from Editorial

-

Scotiabank economist warns on tardy federal budget update

-

Canada retreats from the edge of the mortgage renewal cliff

Advertisement 6

Article content

A 50-year-old DIY investor with a portfolio over $1 million and a reader worried about irrational markets ask how much they should pay attention to the news in their long-term savings decisions. Portfolio Manager John De Goey discusses rate cuts, asset bubbles and recessionary alarms, and how much those issues should play into investing decisions. Read more

As inflation and the cost of living soar for Canadians, consumers are getting ‘justifiably angry’ about junk fees — We look at what the problem is, and what are some solutions. Read more

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

Bank of Canada will cut 50 bps, big bank economists say

2024-12-09 13:05:08