Trouble with bubbles is they are hard to spot when you’re in one

Article content

The S&P 500 has hit 50, yes 50, records this year.

With the market up 24 per cent, forecasters like Goldman Sachs and others are predicting new heights to come.

So let the good times roll or should we be worried?

According to Deutsche Bank Research, the S&P 500’s CAPE ratio — the cyclically adjusted price-to-earnings ratio often used to indicate if a market is undervalued or overvalued — has only been higher twice in the last century.

Advertisement 2

Article content

This got macro strategist Henry Allen thinking about three other times when market valuations were historically high.

Probably the most famous bubble in our memory is the dotcom boom. In the late 1990s, the S&P 500 more than tripled over five years, but then plunged into a lengthy correction that saw it post three annual declines in a row, something that hadn’t happened since the Second World War, said Allen.

How does that compare to today? Like that relentless rally, the S&P 500 is now on track to post back-to-back annual gains above 20 per cent for the first time since 1997 to 1998, he said.

Then, like now, a narrow group of tech stocks was driving gains, and the Federal Reserve was cutting interest rates.

Then there was the global financial crisis — few saw it coming and when it did most failed to understand how bad it would be, said Allen.

In 2007 before the crisis hit, markets were in pretty good shape with the S&P 500 exceeding its previous record in March 2000. Volatility was low and credit spreads were tight, just like today.

The crisis in 2008 came after a long period of calm and the same can be said of today, a decade and a half after the financial crisis.

Article content

Advertisement 3

Article content

“As the economist Hyman Minsky argued, a lengthy period of stability can itself be a destabilizing force. That’s because it can induce risk-taking and complacency that itself lays the foundations for the next period of financial instability,” wrote Allen.

2000 sent the world reeling into COVID shock, but when markets bounced back in 2021, it was big time, fuelled by monetary and fiscal stimulus that exceeded the aid dispatched during the global financial crisis.

Valuations became increasingly stretched, said Allen, and by November of that year there were signs the rally was turning. What followed was a massive selloff in 2022 in which the S&P 500 fell 25 per cent from its peak.

The bottom line: “In all three cases, there was little scope for further gains since valuations were already so stretched to start with, and they were each followed by a significant correction,” he said.

One striking thing about all three episodes in retrospect is the “bubble mindset” and a strong belief that good times will continue, said Allen. In 2000, the Congressional Budget Office was predicting that the United States would pay down its entire national debt and in the mid-2000s before the financial crisis, there was talk of the “Great Moderation,” a time of macroeconomic stability. When the global economy began to recover from the shock of COVID-19, there was skepticism that inflation would get as bad as it did.

Advertisement 4

Article content

“So turning points can happen quickly,” he wrote.

Sign up here to get Posthaste delivered straight to your inbox.

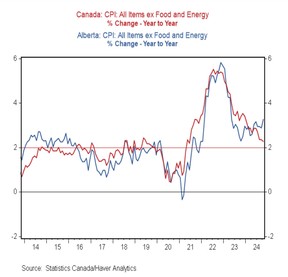

If you thought inflation was bad, spare a thought for Albertans.

Canada’s inflation rate ticked back up to 2 per cent in October, but in wild rose country it hit 3 per cent, said Douglas Porter, chief economist at BMO Capital Markets in a note.

Seven of the other provinces are cool in comparison, coming in under 2 per cent. Ontario was bang on the national average and British Columbia a bit hotter at 2.4 per cent.

Alberta’s robust housing market might be one explanation, but the inflation goes beyond shelter costs, said Porter — “it’s almost across the board.”

Core inflation, which strips out the more volatile components, has also been trending higher in this province. At 3.3 per cent it is also a full percentage point above the national average.

The bottom line is that Alberta’s economy is running hotter, said Porter, scoring well above average on GDP, employment and population growth.

“One could argue that the high inflation is a price of success,” he said.

Advertisement 5

Article content

- Today’s Data: Canada industrial product price and raw material price index, United States exiting home sales

- Earnings: Deere & Co., Intuit Inc.

Recommended from Editorial

-

How much can the average inheritance help young homebuyers?

-

These two cities are at risk of sharp rise in mortgage arrears

At ages 57 and 52, Leo and Siobahn would like to semi-retire when they each turn 60, but they will be carrying a significant mortgage well into retirement – something to be avoided at all costs, according to many of the financial planning guides Leo has read. Is this really such a bad thing — especially since their $2.6 million forever B.C. home has a separate, two-bedroom income-generating suite? Family Finance runs the numbers.

Hard earned truths

In an ongoing series about what the next generation needs to know to build wealth, we offer Hard Earned Truth #7: The pros can’t pick stocks and neither can you. So, what should an investor do? Read on.

Advertisement 6

Article content

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content

S&P 500 hits 50th record this year — what history tells us

2024-11-21 13:10:03