Governor Tiff Macklem could stick to a gradual pace of monetary easing

Article content

The Bank of Canada will be able to pull off a soft landing for the country’s economy without resorting to half-point interest rate cuts, analysts say.

The central bank will keep gradually lowering borrowing costs at quarter percentage-point increments over the next five decisions, according to the median estimates of economists surveyed by Bloomberg. They see the benchmark overnight rate falling from the current 4.25 per cent down to three per cent by April 2025, lower than forecast in the previous survey.

Advertisement 2

Article content

At the same time, the survey projects economic growth will average a two per cent annualized clip in the last three quarters of 2025, a boon for the central bank as it aims to prevent a sharp economic downturn after one of the most aggressive hiking cycles in its history. The survey of 28 economists was conducted between Sept. 20 and Sept. 25.

The results suggest economists think governor Tiff Macklem can stick to a gradual pace of monetary easing and still keep the economy out of recession. They also signal confidence that the bank’s tightening campaign has successfully tamed inflation, with the survey projecting price gains will sustainably reach the two per cent inflation target starting in the second quarter of 2025. That’s earlier than expected in previous surveys and by policymakers in their July Monetary Policy Report. The rate is seen stabilizing at that level until early 2026.

But Canada’s economy is increasingly showing signs of weakness. Consumption growth has slowed, despite population growth that’s among the fastest in the world. The jobless rate hit 6.6 per cent in August, up 1.6 percentage points since the start of 2023, with youth and newcomer unemployment rates much higher.

Advertisement 3

Article content

In the survey, economists also boosted their forecasts for peak unemployment in the country, which is now expected to hit 6.8 per cent at the end of this year and the beginning of the next.

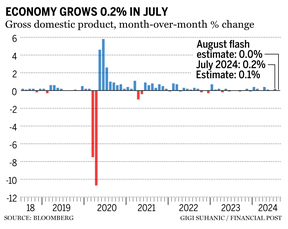

On Friday, Statistics Canada released data showing economic growth tracking around one per cent in the third quarter of 2024, below the forecasts of economists and the bank. Policymakers have said they wanted the economy to grow faster to prevent an undershoot of the inflation target. Earlier this week, Macklem said he wanted growth to pick up above two per cent.

Recommended from Editorial

-

Economy grew by 0.2% in July, falling behind Bank of Canada’s forecast

-

Number of active businesses fell by most since the pandemic

-

Macklem says ‘we need to stick the landing’ as inflation falls to 2% target

Markets are less sanguine about the outlook, and traders in overnight swaps put the odds of a 50 basis-point cut at the central bank’s next meeting at just over a coinflip. They’re also betting on the policy rate falling to 2.5 per cent by the end of 2025, a quarter point lower than the 2.75 per cent expected by economists.

Bloomberg.com

Article content

Canadian economic soft landing possible without jumbo rate cuts

2024-09-27 18:12:34