The number of businesses being created is slowing and the number closing is rising

Article content

Amid national concerns about poor productivity, new evidence suggests that Canada’s business landscape has never fully recovered from the pandemic.

A report by TD Economics out this week looks at business dynamism, which is measured by the rates at which businesses enter the market, grow and leave the market.

It was already slipping before the pandemic, but the slow rate of business entries and a rise in bankruptcies since then suggests Canada’s business dynamism is stuck in a post-pandemic slump, said the report’s authors economist Maria Solovieva and research analyst Matt Palucci.

Advertisement 2

Article content

“Such dynamics can lead to slower growth, stagnation or even decline in the number of companies in the economy,” they said.

Canada’s business exit rate fell dramatically during the pandemic years thanks to government aid, and in the rebound after the lockdowns business entries surged. But since then the entry rate has flattened and the exit rate has accelerated.

What’s striking is the comparison to the United States.

Both countries experienced a boost after COVID, but while the Canadian rebound has faltered, the U.S. recovery has remained robust.

By the end of 2022 Canada’s net entry rate had fallen below the pre-pandemic average while the U.S. had surpassed it. In 2023, entries and new business applications in the United States remained above average, while in Canada they stagnated, said the report.

“Deteriorating growth in new businesses points to a widening gap in business vibrancy between Canada and the U.S.,” they said.

In Canada, mid-sized companies, especially in manufacturing, appear to be taking the brunt of the downturn.

“Despite their potentially lower productivity compared to large firms, the softer growth in business creation among these cohorts could be concerning for the Canadian economy, as it may signal fewer opportunities for scaling up,” said the report.

Article content

Advertisement 3

Article content

The outlook for Canadian business should brighten as interest rates continue to come down, said the authors, but there is also more government can do to help.

Reducing regulatory barriers, encouraging entrepreneurship and innovation would create a better environment for business dynamism.

“These measures could revive business formation and support long-term economic growth in Canada,” they said.

Sign up here to get Posthaste delivered straight to your inbox.

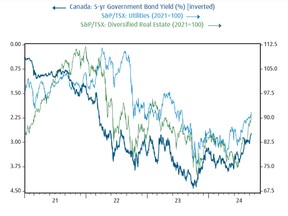

Rate-sensitive equities are getting some long-awaited relief now that interest rates are coming down. Today’s chart by Robert Kavcic, senior economist at BMO Capital Markets, shows how Canadian utilities and Real Estate Investment Trusts (REITs) have jumped since mid-June as the 5-year GoC yield shed more than 100 basis points.

“Other areas of the market, like higher dividend-paying equities, have also benefitted after a few years in the basement,” said Kavcic.

Physical real estate will take longer, said the economist. Data from the Canadian Real Estate Association Monday showed the housing market is still stuck in a holding pattern.

Advertisement 4

Article content

BMO expects things will start to warm up when mortgage rates follow yields down below the 4 per cent level.

- Statistics Canada releases its latest reading for inflation today in the consumer price index for August. The annual inflation rate slowed to 2.5 per cent in July, down from 2.7 per cent in June.

- Today’s Data: Canada housing starts, United States retail sales, industrial production, capacity utilization and NAHB housing market index

Recommended from Editorial

-

Biggest risk to oil prices might not be what everybody thinks

-

Suspense ahead of the Fed has rarely been higher

Jurisdictions across the globe have an “infrastructure deficit,” which is one reason why there’s a lot of chatter about investing in the fixes, whether it be the companies making the changes or the assets themselves. Veteran investor David Kaufman lays out your investing options.

Advertisement 5

Article content

Build your wealth

Are you a Canadian millennial, or younger (or know someone who is), with a long-term wealth building goal? Do you need free advice on getting there? Drop us a line with your contact info and wealth goal and you could be featured anonymously in a new column on what it takes to build wealth.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Canada’s economy suffering from business dynamism slump

2024-09-17 12:00:12