Economists say the numbers out today could sway the Bank of Canada to hold interest rates in July

Article content

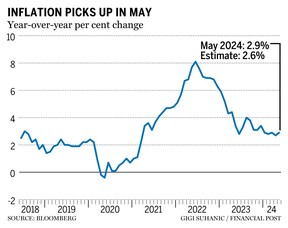

May’s inflation rate came in surprisingly high, leading some economists to cast doubt on their predictions of a second interest rate cut next month.

Statistics Canada on Tuesday said inflation accelerated to 2.9 per cent for May, beating economists’ expectations of further easing from April’s 2.7 per cent increase.

The jump puts inflation on the upper edge of the Bank of Canada’s target range of between one per cent and three per cent.

Advertisement 2

Article content

Given the surprise figures, economists are now rethinking their interest rate predictions for the year. Here’s what some of them had to say about the announcement:

‘Not the best news’: Canadian Chamber of Commerce

Andrew DiCapua, a senior economist at the Canadian Chamber of Commerce, said the Bank of Canada is now likely to pause at its July meeting.

“Not the best news on the Canadian front this morning,” he said in a note. “The increase in services inflation is not helpful, especially as wage growth is elevated. The risk of a strong rebound in the housing market hasn’t materialized yet, but slowing shelter inflation is welcome news.”

DiCapua said the odds of a July cut are lower, but the final decision will still depend on the central bank’s economic forecasts.

“The (Bank of Canada) will want to take a slow and measured approach, especially with inflation accelerating,” he said. “This bumpy road on inflation could keep the bank overly restrictive for the Canadian economy risking any soft landing.”

July cut on ‘shaky ground’: Capital Economics

The strong monthly gains on some core measures are “cause for concern,” according to Olivia Cross, a North America economist at Capital Economics Ltd.

Article content

Advertisement 3

Article content

“However, with some of that strength due to factors that are likely to be one-offs, and given there is another CPI report before the late July meeting, for now we are sticking with our view that the (Bank of Canada) will cut again next month,” she said in a note.

Cross pointed to several measures that are not likely to have further gains, including the 2.4 per cent hike in travel services, a 0.5 per cent jump in food prices and a 0.9 per cent month-over-month climb in rent.

‘Shaves the odds’ of a July cut: BMO

Douglas Porter, chief economist with the Bank of Montreal, said future data points will ultimately decide the prospects of a July cut, but the odds certainly got longer after the inflation spike.

“No bones about it, this is not what the Bank of Canada wanted to see at this point,” he said in a statement. “With inflation back on a bumpy path, the outlook for BoC moves is similarly bumpy. For now, our official call remains that the next BoC rate cut will be in September, and this report does nothing to move that needle.”

‘Disappointment’: TD

“While this wasn’t as big of a letdown as the Oilers’ game last night, today’s CPI print was a disappointment,” James Orlando, director and senior economist at Toronto-Dominion Bank, said in a note.

Advertisement 4

Article content

“Not only did the headline print unexpectedly rise, the average of the BoC’s core inflation rates increased for the first time in 2024. This was driven by big price swings in a number of services categories.”

Orlando is predicting a pause in July before another cut in September.

Recommended from Editorial

-

Inflation heats up again

-

Where investors should do if higher inflation becomes normal

‘Wrong direction’: CIBC

The most recent inflation data “moved in the wrong direction,” Katherine Judge, director and senior economist at CIBC Capital Markets, said in a statement.

“Overall, with the data showing much faster price pressures than expected, this casts a lot of doubt on the possibility of a July cut.”

• Email: bcousins@postmedia.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Inflation data ‘cast doubt’ on July rate cut

2024-06-25 15:20:13