Signs that more and more consumers having financial difficulty as interest rates rise

Article content

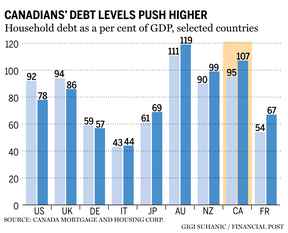

Canada’s household debt, which already exceeds the size of the size of the country’s economy and leads G7 nations, is seeing even greater increases as interest rates rise, according to a report published by the Canada Mortgage and Housing Corp.

Advertisement 2

Article content

The May 23 report said concerns about fallout from high household debt, around three-quarters of which comes from mortgages, are most pressing for those with lower incomes because they also tend to be more highly indebted. So not only do they rely more on having jobs to service the debt, but they are now “facing real pressure” from higher housing costs.

Article content

“We see early warning signs that more and more consumers are getting into financial difficulties,” the report warned, adding that it will soon publish a more detailed report on these troubles.

We see early warning signs that more and more consumers are getting into financial difficulties

CMHC report

“Household debt in Canada has been rising inexorably…. Unfortunately, (this) makes the economy vulnerable to any global economic crisis.”

The housing authority said there are concerns Canadians’ high debt levels could be exacerbated over the longer term, depending on the trajectory of interest rates.

Article content

Advertisement 3

Article content

“Although the last decade was characterized by historically low interest rates … there is no guarantee that we will return to such a pattern after currently high inflation is addressed and interest rates start to decline,” the report said.

It added that interest rates may need to remain high if some assessments are correct about increased demands for investment to address an aging population, infrastructure needs and re-shoring of manufacturing.

The report, authored by CMHC’s deputy chief economist Aled ab Iorwerth, concluded that risks to Canada’s economy remain high as household debt levels continue to grow.

He noted that while Canada’s debt has climbed relative to the country’s gross domestic product — even surpassing it in 2021 — household debt in the United States has by contrast fallen relative to GDP, from 100 per cent in 2008 to about 75 per cent in 2021.

Advertisement 4

Article content

“While U.S. households reduced debt, Canadians increased theirs and this will likely continue to increase unless we address affordability in the housing market,” the report said.

Statistics Canada data released May 16 showed soaring mortgage interest costs and higher rents in April helped drive the first acceleration in headline consumer inflation since June 2022.

-

Bank of Canada sees signs consumers having debt trouble

-

Canadians about to be hit by full shock of rising interest rates

-

Half of Ontario insolvencies filed by millennials

The consumer price index (CPI) figures revealed a 28.5 per cent increase in mortgage interest costs that month compared to a year earlier, reflecting more people renewing mortgages at higher rates. That marked the 10th consecutive month that mortgage interest costs had risen and the fourth straight month that year-over-year increases topped 20 per cent.

• Email: bshecter@nationalpost.com | Twitter: BatPost

Families ‘facing real pressure’ as household debt levels rise: CMHC

2023-05-23 16:30:42

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation